The finance industry, known for its dynamic and highly competitive nature, depends on the transformative power of knowledge management.

Knowledge management has rapidly turned into an inherent component of the industry’s framework, driving strategic revision and propelling organizations into an era centered on data-driven insights. As evidenced in various industries, from retail businesses to the financial services sector, knowledge is now the primary currency.

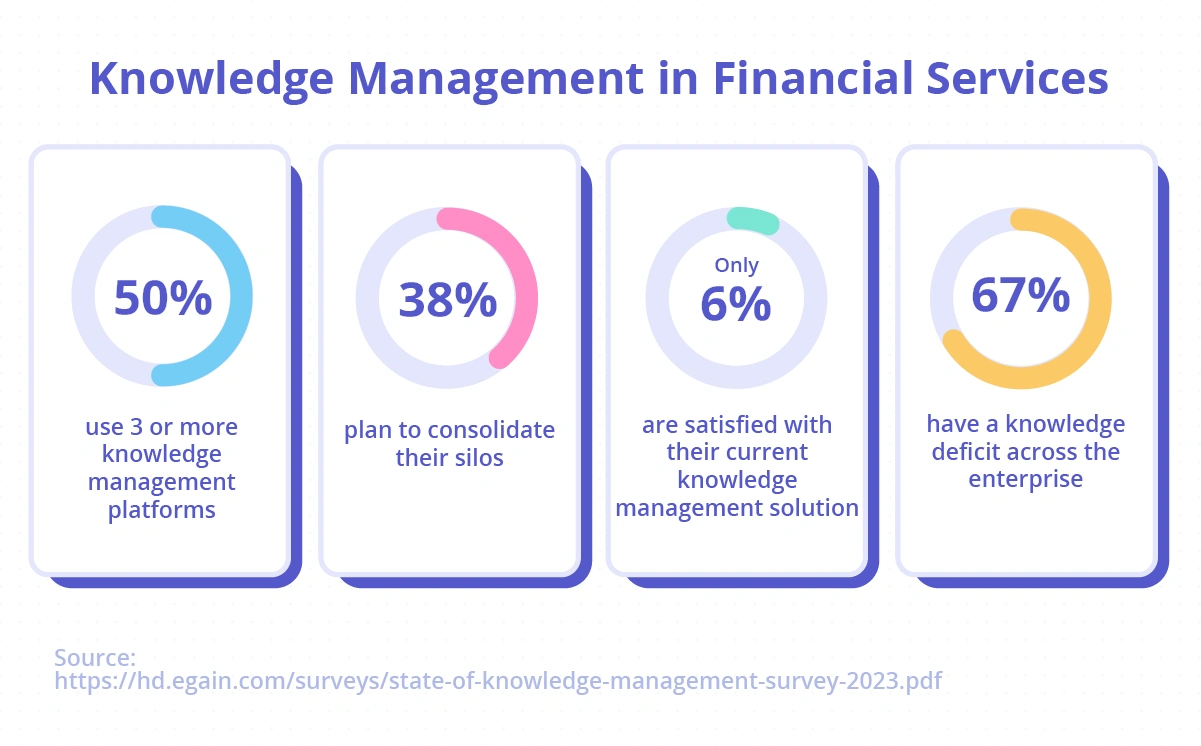

The benefits reaped from employing knowledge management in the finance industry are substantial, from cost minimization to risk mitigation. Unfortunately, financial services organizations have the lowest satisfaction with their current knowledge management out of any industry, with only 6% expressing a high degree of satisfaction.

Effectively managing knowledge in finance requires robust procedures for data capture and analysis and the implementation of advanced strategies and technologies to leverage accumulated information.

Challenges faced by financial services organizations

Finance is a critical sector that contributes significantly to any nation's economic growth and development. This industry is constantly evolving, adapting to new technologies, regulations, and changing economic climates.

With 50% of financial services organizations using 3 or more knowledge management systems at a time and 67% having a knowledge deficit, the finance industry faces unique and demanding challenges that must be addressed for the sector to develop and thrive.

Slow response time

Financial services organizations often face the challenge of slow response times, which can stem from bureaucratic processes, complex approval hierarchies, or inefficient communication channels. These delays hinder agility, impacting customer satisfaction and potentially resulting in lost business opportunities. In a fast-paced industry where timely actions can make or break deals, overcoming slow response times is critical for maintaining competitiveness and fostering trust with clients.

Inaccurate and outdated information

With vast volumes of data generated daily, ensuring the accuracy, relevance, and timeliness of information is paramount. Outdated data can lead to flawed analyses, erroneous decision-making, and compliance issues. Moreover, inaccuracies can erode client trust and damage reputation. Addressing this challenge requires robust data governance frameworks, advanced analytics capabilities, and proactive measures to continuously validate and update information sources, thereby enhancing the reliability and effectiveness of financial services operations.

Regulatory compliance

Governments and regulators worldwide are continuously updating rules and regulations with a focus on economic stability, transparency, and protecting the interests of customers. Staying abreast of these changes, understanding them, and ensuring compliance cost financial services organizations both time and money.

The importance of knowledge management in the financial industry

Knowledge management in finance is crucial as it allows organizations to understand, analyze, and leverage the vast amounts of fiscal and monetary data that financial institutions, investors, or businesses have at their disposal. By harnessing the power of this data, organizations can make decisions that are proactive, predictive, and prescient, giving them a competitive edge in the market.

The edge obtained through knowledge management in finance is not simply gained from the sheer volume of data, but from the quality, relevance, and timeliness of such data. A focused and systematic approach to managing this knowledge can aid enterprises in anticipating market trends, evaluating investment opportunities, and identifying potential risks. Such crucial insights can profoundly influence strategic planning, policy-making, and decision-making processes in finance.

Furthermore, efficiently managing knowledge can bring about cost savings, increased productivity, and process optimization which are of utmost importance in the financial sector. This is especially important in highly competitive environments, where businesses must continually innovate and adapt.

The strategic importance of knowledge management in finance goes beyond internal decision-making processes. Businesses can utilize this knowledge management to foster relationships with clients, partners, and stakeholders by providing them with valuable, relevant, and timely information and insights.

The role of knowledge management systems in finance

The integration of knowledge management systems and different types of knowledge management into the financial industry is a crucial aspect allowing businesses to efficiently capture, process, and utilize valuable knowledge to improve their overall performance, make accurate financial projections and well-informed decisions, all while minimizing risk exposure.

Knowledge management systems act as a repository, storing immense volumes of data in a secure manner. By retrieving and curating relevant financial data, they become instrumental in providing vital insights and revealing patterns that can determine the financial health of a company or the volatility of a specific market.

As the lifeline of the financial sector is a stream of accurate data and the ability to predict and foresee economic trends, these knowledge management systems play a major role in providing a competitive edge. They aid in streamlining and automating processes, such as financial forecasting, risk management, and market analysis, in a cost-effective way. By reducing human error and improving processing times, knowledge management systems allow individuals and organizations to focus on strategic tasks, leading to more efficient results and better performance metrics.

One of the main uses of these systems is in managing and mitigating risk. The financial industry is notoriously susceptible to unforeseeable risk factors. By incorporating these systems, professionals in the sector can have a comprehensive overview of potential risks and formulate achievable strategies to manage risk effectively. This decreases the likelihood of unexpected losses and increases resilience amid market uncertainties.

The successful integration of knowledge management systems in finance requires comprehensive planning, organizational commitment, and rigorous execution. Developing an effective learning culture, investing in the right technologies, and lending continuous support to the workforce in utilizing these systems effectively are just some strategies to ensure their successful adoption.

Top 5 benefits of knowledge management in finance

The benefits of implementing knowledge management in finance are extensive and wide-ranging. From considerably reducing the cost and time associated with manual data processing to enhancing predictive abilities for informed decision-making, these advantages contribute toward enhanced profitability and growth.

Streamlines operational efficiency

Knowledge management in finance significantly enhances operational efficiency by facilitating the systematic organization and accessibility of crucial information. By processing large volumes of financial data and translating it into actionable knowledge, organizations can streamline processes such as decision-making, risk management, and compliance. With streamlined access to relevant knowledge, financial institutions can process data faster and more accurately. Additionally, knowledge management ensures that best practices and processes are ingrained and replicated throughout the organization, leading to reduced operational costs.

Enhances decision-making

Knowledge management fosters better decision-making, giving financial professionals a reliable foundation for actions they can undertake. It aids in the reduction of financial risks and helps avoid unnecessary costs, thanks to the availability of comprehensive data and well-analyzed insights. By having a robust knowledge management system, financial institutions can proactively identify potential issues and opportunities, which allow them to make informed strategic decisions.

Encourages knowledge sharing

In finance, where departments are often siloed, sharing and incorporating knowledge from various sources can lead to better cross-functional collaboration. Knowledge management cultivates an environment of collaboration rather than competition, establishing robust communication channels, and enabling employees to share their expertise and learn from one another, leading to a proficient workforce.

Additionally, it fends off knowledge loss due to staff turnover through the storage and easy retrieval of critical information. New hires can appreciate a smooth onboarding process by accessing and learning from the previously stored data, reducing the transition period, and ensuring the continuity of operations.

Aids in compliance and regulatory adherence

The financial sector is marked by many rules and regulations, which change constantly. An optimal knowledge management system ensures that all relevant regulatory updates are known, tracked, and adhered to. Through centralized repositories, financial institutions can organize regulatory requirements and guidelines for easy access. Automated processes ensure timely dissemination of regulatory changes, enabling swift adjustments to policies and procedures. Standardized processes documented within knowledge management systems promote consistency in compliance efforts. This reduces the chances of non-compliance, a costly mistake in the financial field.

Improves customer service

By having a comprehensive knowledge management system in place, financial institutions can provide enhanced, personalized customer experiences. Quick access to information improves response time to customer queries or complaints. Moreover, a deeper understanding of customer patterns and behaviors, gleaned from analyzed data, can enable more targeted and effective service offerings. With comprehensive customer data and feedback at hand, companies can use knowledge management to meet and exceed customer expectations while also predicting future market trends.

Getting started with knowledge management in finance

Knowledge management, when leveraged adeptly, becomes a vital tool for finance-led enterprise growth and competitiveness, delivering a wealth of benefits and considerable strategic value. Future trends point to an enriched customer experience, improved employee productivity, and overall, a sector thriving in its ability to harness, manage, and wield its knowledge repository.

Visit our finance industry solution page to learn how you can enhance processes, reduce audit time and make your financial services experiences faster and easier, whether in banking, lending, investment, or accounting.